How To GST Return Form Document Writer Online?

Easy-to-use PDF software

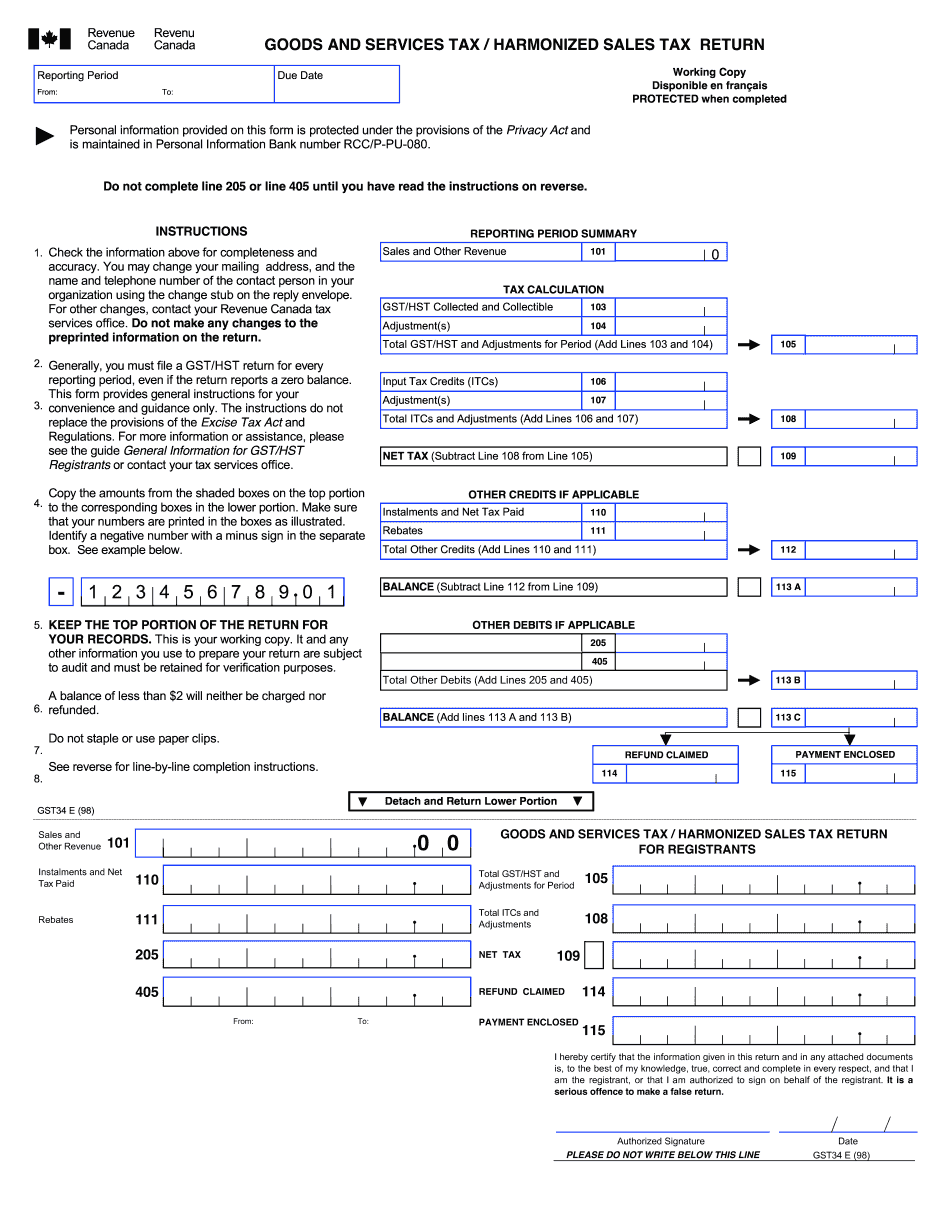

What is GST Return Form?

GST return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

How to start Document Writer for GST Return Form

To work on your PDF, you need to find a decent Document Writer for GST Return Form. Our web-based service helps you to simplify the editing process providing you with an array of professional tools. You can explore the entire suite in no time using an intuitive interface. The solution saves you time and effort and delights you with a high-level user experience. To start Document Writer for GST Return Form, use the step-by-step guidelines below:

- To begin, open up your form using our advanced editor.

- Pick a tool to modify your document properly.

- Click on any page and start applying your tool.

- Focus on text, changing the size and the font.

- Double check the PDF to eliminate typos and mistakes.

- Save the edits you've made by clicking Done.

Our tool is the fastest and easiest way to cope with red tape. Plus, the solution is safe and processes your data according to industry-standard security, complying with GDPR, ESIGN, and so on. Feel confident knowing that your information is under protection. Try out the service now and get the most out of it to establish a flexible and robust workflow.

Benefits of trying our Document Writer for GST Return Form

Looking for necessary tools can take hours. Plus, you have no guarantee that you will find a service that suits your needs. Try our Document Writer for GST Return Form, and you don't waste your time. The solution helps you complete and improve your documents in minutes providing you with professional editing tools. So that you forget about scanning and printing documents forever. This is the very first but important step towards paperless document management. Here are five reasons why you should give the solution a shot:

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of GST Return Form?